The Quiet Power of Stealth Wealth: How to Build Wealth Without Flaunting It

–

We live in an age when social media rewards spectacle. A quick scroll reveals private jets, designer handbags, luxury villas, and champagne-fueled dinners—images carefully curated to prove success. Yet beneath this glossy surface, another philosophy is quietly taking hold among those who know wealth most intimately: stealth wealth. It is not about deprivation or secrecy, but about choosing to build, preserve, and enjoy wealth without turning it into a performance. In its purest form, stealth wealth is about freedom—the ability to live well without the burden of appearances.

What Is Stealth Wealth?

At its heart, stealth wealth is simple: it is having more than you show. A person may control a successful business, a global investment portfolio, or a valuable collection of assets, yet live in a way that doesn’t scream “wealthy.” Instead of signaling status through flashy cars or branded clothing, stealth-wealth individuals favor discretion, quality, and understatement. They derive satisfaction not from being seen as wealthy, but from the independence and stability their wealth provides.

Why Keep Wealth Quiet?

The reasons for choosing discretion are both practical and psychological. From a practical standpoint, maintaining a modest public profile brings safety and privacy; it limits unwanted attention, speculation, and even security risks. It also protects against the subtle but powerful pressure of social comparison. Without the need to “keep up,” you are free from the treadmill of lifestyle inflation.

On a deeper level, quiet wealth fosters peace of mind. It replaces the fleeting validation of external approval with the lasting satisfaction of financial security and self-determined choices. It is not about renouncing pleasure, but about detaching one’s identity from the need to display it.

The Compounding Advantage: Growth Over Consumption

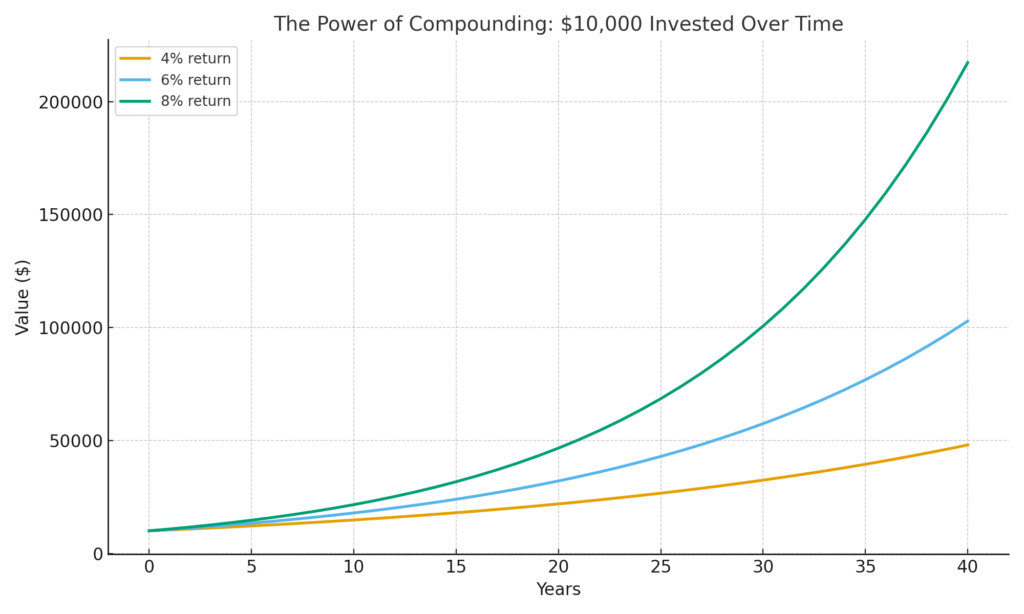

Perhaps the most powerful argument for stealth wealth lies in the mathematics of compounding. Every dollar that is not spent on temporary status becomes a dollar that can work for you. Consumption ends the moment the purchase is made; an investment, however, begins a journey of growth.

Consider the difference: spending $10,000 on a luxury vacation buys a week of enjoyment. Investing that same amount at an average annual return of 8% turns it into more than $100,000 over thirty years. What is fleeting for one moment becomes transformative across decades. This quiet compounding is what turns modest savers into financial powerhouses, and what allows wealth to last across generations.

In practice, this means re-framing luxury. Instead of measuring success by what is consumed today, the stealth-wealth individual sees wealth in the freedoms tomorrow will bring: the ability to retire early, to choose meaningful work, to support loved ones, or to give generously without hesitation. Compounding, not consumption, is the true luxury.

Private Assets, Trusts, and the Architecture of Lasting Wealth

For many who practice stealth wealth, the real foundation of their fortune lies not in visible consumption but in carefully designed structures that quietly compound wealth behind the scenes. Private assets, tax-efficient vehicles, and family trusts are more than tools for the ultra-rich—they are frameworks for building resilience, deferring taxation, and reducing the temptation of immediate consumption.

Private Assets: Real estate, private equity, venture capital, and direct business ownership play a crucial role. Unlike publicly traded stocks, these assets often remain invisible to the casual observer, yet they generate long-term growth and cash flow. They offer diversification, privacy, and, in many cases, tax advantages. A modest lifestyle, supported by the quiet cash flow of rental income or private dividends, is the hallmark of wealth that doesn’t need to announce itself.

Tax Shelters and Deferral: Taxes are among the greatest erosions of wealth. By using legitimate tax shelters—such as retirement accounts, insurance structures, or charitable foundations—wealth can grow undisturbed for decades. The benefit is twofold: compounding accelerates when it is not shaved down annually by taxes, and the deliberate deferral creates psychological distance from immediate consumption. When capital is tied up in tax-protected vehicles, it is not sitting in a checking account begging to be spent—it is working invisibly for the future.

Family Trusts: The most enduring instrument of stealth wealth is the family trust. By placing assets into trust structures, families create continuity across generations. Trusts ensure that wealth is managed responsibly, taxes are minimized, and inheritance disputes are softened. Just as importantly, they build guardrails: by restricting access or distributing capital in measured ways, trusts prevent wealth from being squandered in bursts of consumption. They preserve not only money, but values—discipline, foresight, and stewardship.

What ties these instruments together is their subtlety. A luxury car announces itself in the driveway; a family trust does not. A shopping spree drains tomorrow’s reserves; a tax-sheltered portfolio multiplies them quietly. By shifting resources into private assets and long-term structures, the wealthy reduce the temptation of spectacle and reinforce habits of patience. The very architecture of their wealth makes ostentation impractical and unnecessary.

Stealth Wealth Among the Ultra-Rich

The global population of the ultra-wealthy is significant. Reports estimate that more than 426,000 individuals worldwide hold net worth above $30 million, while the broader ultra-high-net-worth category numbers closer to 626,000. These individuals collectively control a vast share of global wealth.

And yet, despite the stereotype of extravagance, many of them prefer to live quietly. Wealth advisers frequently observe that privacy, confidentiality, and discretion are prized as much as returns. In London, one study noted that “discretion is key” among the city’s richest residents, many of whom avoid ostentation in favor of understated elegance. Lifestyle research likewise shows a preference for experiences, philanthropy, and wellness over conspicuous consumption.

Exact numbers are difficult to pin down—stealth wealth, by its nature, avoids publicity. But the anecdotal evidence is compelling: a meaningful share of the ultra-rich see invisibility as the ultimate luxury. For them, discretion is not just taste—it is a form of risk management, legacy planning, and personal freedom. And what holds true at the highest levels of wealth can just as powerfully guide anyone building long-term security.

The Mindset Shift

Embracing stealth wealth begins with a redefinition of success. Instead of measuring worth by possessions, you measure it by freedom: the freedom to spend your time as you choose, to protect your family, to walk away from compromises, and to enjoy the richness of life’s quieter luxuries. This mindset requires separating self-image from material display and recognizing that true wealth is not about how others see you, but how secure and fulfilled you feel.

Practicing Stealth Wealth

Living with stealth wealth does not mean rejecting beauty or pleasure. It means choosing deliberately. The car you drive may be reliable rather than ostentatious, but the home you live in may be filled with comfort, light, and art that nourishes your soul. Your money flows into investments that grow silently, rather than purchases that depreciate noisily. When you indulge, you do so for yourself—not for applause.

The emphasis is on invisible luxuries: health, privacy, craftsmanship, time. These are the treasures that hold value long after logos fade. By resisting lifestyle inflation and aligning spending with authentic joy, you create not only wealth, but resilience.

Balance and Joy

Stealth wealth does not forbid indulgence; it refines it. A first-class flight, a beautiful watch, or a fine bottle of wine can still bring delight. The difference is intention. These luxuries are savored not as signals to the world, but as personal moments of enjoyment. In this way, wealth is not diminished, but deepened. It becomes a private art rather than a public performance.

Consider the entrepreneur who sold a company yet remained in the same family home, channeling his wealth into philanthropy rather than mansions. Or the retiree whose real estate empire funds his freedom, yet whose mornings are spent quietly gardening beside his neighbors. Or the young professional who prioritizes maxing out long-term investments over upgrading to a flashy car, ensuring decades of stability. These stories embody the essence of stealth wealth: power without spectacle.

A Gentle Challenge

For those curious to explore this path, begin with small experiments. Audit your spending for a month and ask: how much was for true joy, and how much was for appearances? Try a week without visible branding and notice the relief. Redirect one purchase meant for status into savings and watch your balance grow. Identify three private luxuries that matter only to you, and lean into those. In this way, you train both your habits and your mind toward lasting wealth.

Conclusion: The Quiet Luxury of Freedom

Stealth wealth is not about hiding—it is about choosing. It is the deliberate rejection of performance in favor of peace, the shift from short-term show to long-term strength. In a world that equates loudness with success, the quietest form of wealth may be the truest: wealth you don’t need to prove.

–