The Economics of Supercars —

Passion, Prices, and the Real Cost of Owning Speed

Editorial note: Ranges are indicative and vary by region, spec, mileage, provenance, and macro conditions. Charts included below are illustrative to show dynamics, not investment advice.

At the very top of the market, supercars exist somewhere between consumer goods and financial assets. The best examples — limited-run Ferraris, early analog Porsches, the occasional Bugatti or McLaren unicorn — trade on scarcity, provenance, design significance, and sometimes motorsport DNA. That scarcity creates spreads: a low-mileage, first-owner car with the right options, full service history, and matching-numbers documentation can clear auction estimates by wide margins, while a similar car with stories (paintwork, missing records, modifications) can languish at bid. The market is part romance, part spreadsheet, and entirely path-dependent on taste and timing.

Price Dynamics: What Appreciates, What Depreciates, and Why

Beyond general brand strength, two variables dominate appreciation prospects: supply and narrative. Fixed supply (numbered runs, homologation specials) and strong narratives (historic design, motorsport wins, analog-era purity) tend to preserve value. Modern mass-production supercars with long order books face predictable depreciation curves, particularly in the first three years. Over longer horizons, outliers emerge: special variants, manual transmissions in the era they disappeared, and cars that capture a cultural moment. As with art, the story amplifies the price.

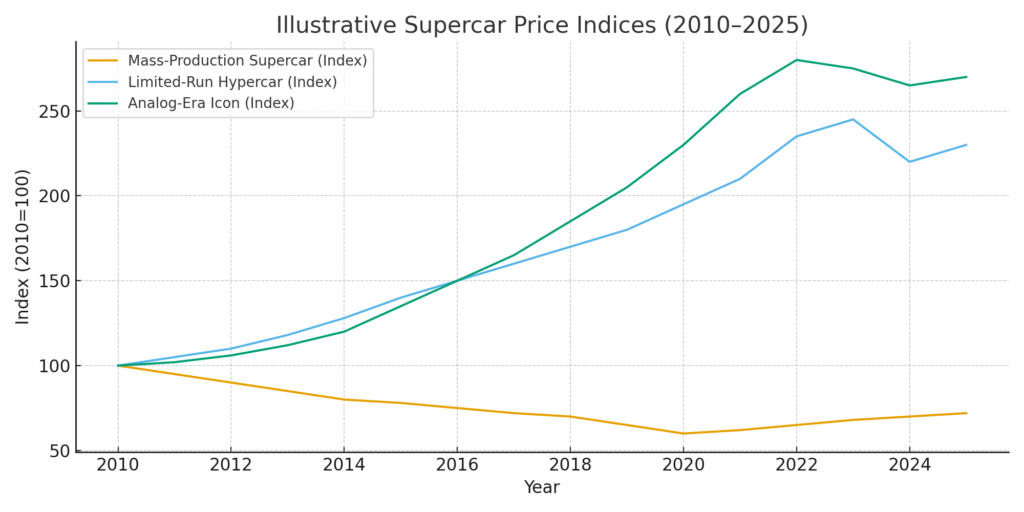

Illustrative Price Indices (2010–2025)

In the chart above, three cohorts tell a familiar story. A mass-production supercar (think widely available V10/V8 models) typically sags from MSRP to a trough as supply meets reality, then stabilizes with enthusiast demand. A limited-run hypercar might jump in the early years, retrace as the frenzy cools, and then rebuild as collectors consolidate top examples. Analog-era icons — particularly manual, naturally aspirated models from the 1990s and 2000s — have outperformed over the last decade as buyers sought visceral, pre-digital experiences. The path is not linear, but the theme is clear: scarcity plus story compounds.

The Role of Provenance

Supercars behave like art when it comes to provenance. First-owner cars with delivery photos, initial spec sheets, and dealer correspondence establish a chain of custody that de-risks the story. Celebrity or motorsport connections add a multiplier, but condition remains king. Over-restoration can be as damaging as neglect; knowledgeable buyers prefer honest originality to gloss.

What the First Five Years Really Cost

Sticker price is the ante, not the total. Over the first five years, owners face a mix of scheduled maintenance, wear items (tires, brakes), insurance, storage, registration, and opportunity cost (the return forgone on capital). Some models add expensive consumables — carbon-ceramic brake service, e-diff components, or complex hydraulic systems. Hypercars introduce a different order of magnitude; logistics alone (covered transport, specialized technicians) can exceed the total annual cost of a “regular” exotic.

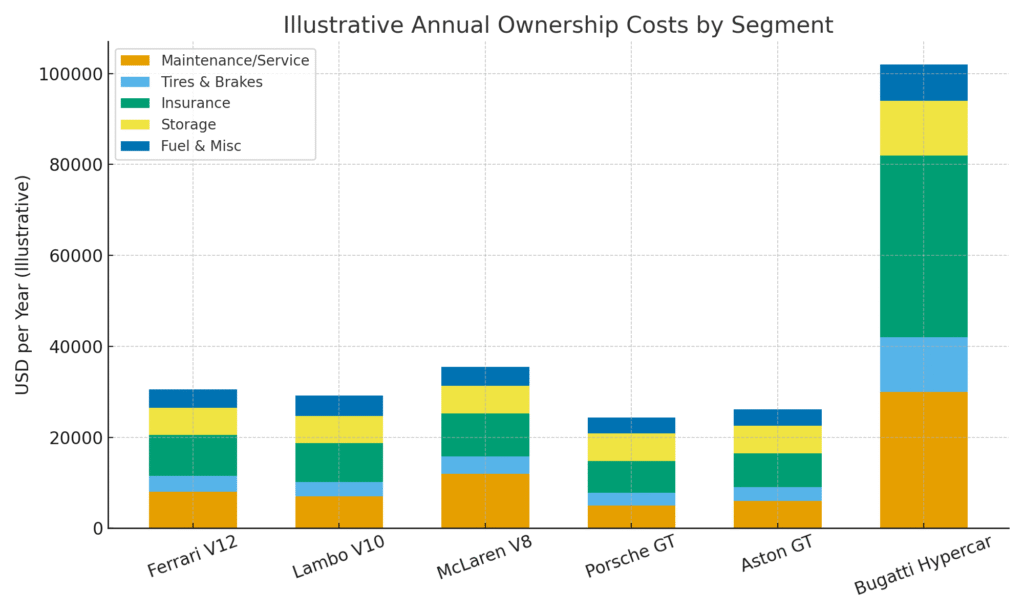

Illustrative Annual Ownership Costs by Segment

The stack shows the typical cash outflow (ex-depreciation) for a well-kept example. Insurance scales with vehicle value, location, and driver history; tires on 20–22″ wheels with soft compounds rarely last more than 8–12k miles, and carbon-ceramic systems keep costs elevated even absent track use. Storage — either at a climate-controlled facility or a properly outfitted private garage — is non-negotiable if you care about long-term value preservation.

Storage: Where You Keep It Determines What It’s Worth

Collectors think about garages the way art buyers think about freeports. Temperature and humidity control, dust management, trickle charging, and a start-and-drive regimen extend mechanical life and protect cosmetics. The delta in resale value between a car stored optimally and one parked haphazardly for years can be measured in five figures. In prime cities, professional storage can add concierge services: battery conditioning, tire rotation, fluid checks, and even detailing.

| Storage Option | Typical Monthly Cost (USD) | What You Get |

|---|---|---|

| Private climate-controlled garage | $200–$600 (outside global hubs) | HVAC control, charging, basic security; owner-managed checks |

| Professional storage facility | $400–$1,200 | HVAC + dust mgmt, battery care, start/drive program, security, reporting |

| Concierge motorsport facility | $1,000–$2,500+ | All of the above plus track logistics, covered transport, detailing, events |

Maintenance: The Predictable and the “That Wasn’t in the Brochure”

Most modern exotics follow annual or mileage-based service schedules, but the real cost is in the details. Oil and filter services are only the beginning; gearbox fluids, diff services, spark plugs on tight V configurations, and belt services on certain engines add time and parts. Then there is the unplanned: a nose-lift system that decides to sulk, a sensor cascade, or a carbon trim piece that can only be ordered through the mothership. Owners who invest in preventative maintenance and specialists — rather than improvisation — tend to see better long-run economics (and fewer auction-day surprises).

| Segment | Typical Annual Service (USD) | Big Ticket Items (Interval) |

|---|---|---|

| Ferrari V12 | $5,000–$9,000 | Major service 3–5 years; carbon ceramic inspect/replace as needed |

| Lamborghini V10 | $4,500–$8,000 | Clutch wear (older e-gear), nose-lift maintenance |

| McLaren V8 TT | $7,000–$12,000 | Hydraulic suspension components; carbon tub inspections |

| Porsche GT | $3,500–$6,000 | Track use accelerates pads/rotors; proactive alignment/geo |

| Aston Martin GT | $4,000–$7,000 | E-diff/gearbox fluid services; carbon-ceramic wear |

| Bugatti Hypercar | $25,000–$60,000+ | Specialist-only service; tires/fluids/transport at hypercar rates |

Insurance: Pricing the Improbable

Exotic insurance blends actuarial math with human behavior. Car value, garaging address, annual mileage, driver history, usage (daily vs occasional), and agreed value all feed the premium. Many UHNW owners schedule cars on specialized policies with generous towing, OEM parts clauses, and limited deductibles. A clean-driver, low-mile policy on a $350k car might land in the mid four figures; million-dollar hypercars can see annuals that resemble a small mortgage.

| Vehicle Value | Typical Annual Premium (USD) | Notes |

|---|---|---|

| $200k–$400k | $5,000–$10,000 | Occasional use, secure storage, clean history |

| $400k–$1M | $9,000–$20,000 | Agreed value, OEM parts rider, track exclusions common |

| $1M+ | $18,000–$40,000+ | Specialist insurers, higher security and storage standards |

Liquidity & Exit: Auction or Private Treaty?

When it is time to sell, owners choose between public auctions and private placement. Auctions deliver transparency and global reach, but charge seller fees and expose the result to the world. Private treaty sales offer discretion and sometimes tighter spreads, particularly for cars where privacy, star provenance, or single-bidder dynamics matter. In either case, presentation wins: comprehensive documentation, paint-meter reports, recent service, high-resolution photography, and cold-start videos often determine whether bidders compete or wait.

Putting It Together: A Model Five-Year Budget

Consider a $350k limited-series GT bought at 2,000 miles and driven 1,500 miles per year, garaged professionally in a major city. The owner keeps a full service history, replaces tires twice, and refreshes pads once. Insurance sits in the mid four figures; storage at a concierge facility runs four digits monthly; detailing and PPF maintenance are routine. Whether this ends profitably depends as much on the macro cycle and the car’s micro narrative as the spreadsheet — but the spreadsheet keeps the romance honest.

| Line Item (Annual) | Illustrative Cost (USD) |

|---|---|

| Insurance (agreed value policy) | $7,500 |

| Storage (concierge, climate-controlled) | $12,000 |

| Maintenance & service | $6,500 |

| Tires & brakes (averaged) | $2,800 |

| Fuel & misc. consumables | $3,500 |

| Detailing / PPF upkeep | $1,500 |

| Total cash outflow (ex-depreciation) | $33,800 |

Capital Calls: The 10-Year View

Financially, the long game is about total cost of enjoyment. Some cars will appreciate, some will not; almost all will demand cash to stay healthy. Owners who do best tend to buy the right example once, service proactively, store professionally, and sell into the right venue at the right time. The hidden economics are simply the price of maintaining optionality: the ability to drive, display, or divest without compromise.

Quick Reference: Cost & Value Levers

| Lever | Effect | Notes |

|---|---|---|

| Limited production / numbered run | Supports value | Supply cap creates floor if narrative endures |

| Manual transmission (era-appropriate) | Premium | Scarcity + engagement; especially late analog years |

| Provenance & records | Premium | Full history, original books, tools, invoices |

| Paintwork / modifications | Discount | Context matters; reversible mods less punitive |

| Storage quality | Value preservation | HVAC, charging, start/drive regimen |

| Service recency | Liquidity | Fresh major service reduces buyer uncertainty |

Unlike stocks or bonds, supercars pay a dividend in joy — the howl of a V12 through a tunnel, the weight of a perfect steering rack on a mountain road, the ritual of a dawn start when the city is still asleep. The hidden economics simply price that dividend. For collectors with the right expectations and the right garages, it remains one of life’s most tactile luxuries: an asset you can drive.

–